COMPARE FLEET INSURANCE

If you own or manage a business that operates a fleet of vehicles, it is essential to have the right insurance in place to protect your assets and your employees.

Fleet insurance is a specialised type of commercial vehicle insurance that covers multiple vehicles, whether they are cars, vans, trucks, or other types of vehicles.

With fleet insurance, you can ensure that all of your vehicles are protected with one comprehensive policy, making it easier to manage your insurance needs.

Our specialist fleet team will discuss the different types of fleet insurance available, the cover options that are available, and how to find the right policy for your business that is affordable.

WHY CHOOSE ALDIUM FOR YOUR FLEET INSURANCE?

At Aldium we have no such thing as an ordinary customer, we deal with Fleet insurances for a widely diverse range of industries and backgrounds and clients who all require support and assistance with the day-today operation of their motor vehicles.

We pride ourselves on helping make life easier for every one of the policyholders insured via ourselves, and to do this we offer many services which are intended to make their lives as straightforward as possible.

Fleet Insurance | Frequently Asked Questions

- What is Fleet Insurance?Fleet Insurance is a type of policy that covers multiple business vehicles and drivers at once. This provides you with one policy to protect all your vehicles on one convenient policy instead of running multiple single policies at once. Once policy, One renewal date, One price. We can arrange cover tailored to you to cover any Cars, Vans, HGV’s, Buses and more including your drivers and goods or tools you carry.

- How much does Fleet Insurance cost?Aldium has access to a wide variety of Insurers so we can compare the market rates for you whilst searching for suitable cover. We also have access to flexible fleet solutions such as pay-by-mile policies. Whatever your needs we can find you the right policy. Call one of our team today on 0151 336 5881

- How many vehicles do I need for a fleet?A typical fleet insurance policy is for 5 or more vehicles, if you have less than 5 vehicles we can look to provide you with a ‘mini-fleet’ policy. There is no maximum size though so whether you have 5 vehicles or 1,500 we can assist.

- Who can drive on a fleet policy?Generally, any driver that your business employs can drive on your Fleet Insurance without you having to update your whole policy. It gives you the flexibility to keep your business moving with minimal hassle.

Client Testimonials

Don’t take our word for it – here’s what our clients say:

From start to finish it was a pleasure, I was really looked after. Would highly recommend 10/10

Paul

Very professional service. Aldium had no problem going throuhgh the small print. thanks guys

Conor

Very knowledgeable and helpful. They helped me get a competitive quote

Martin

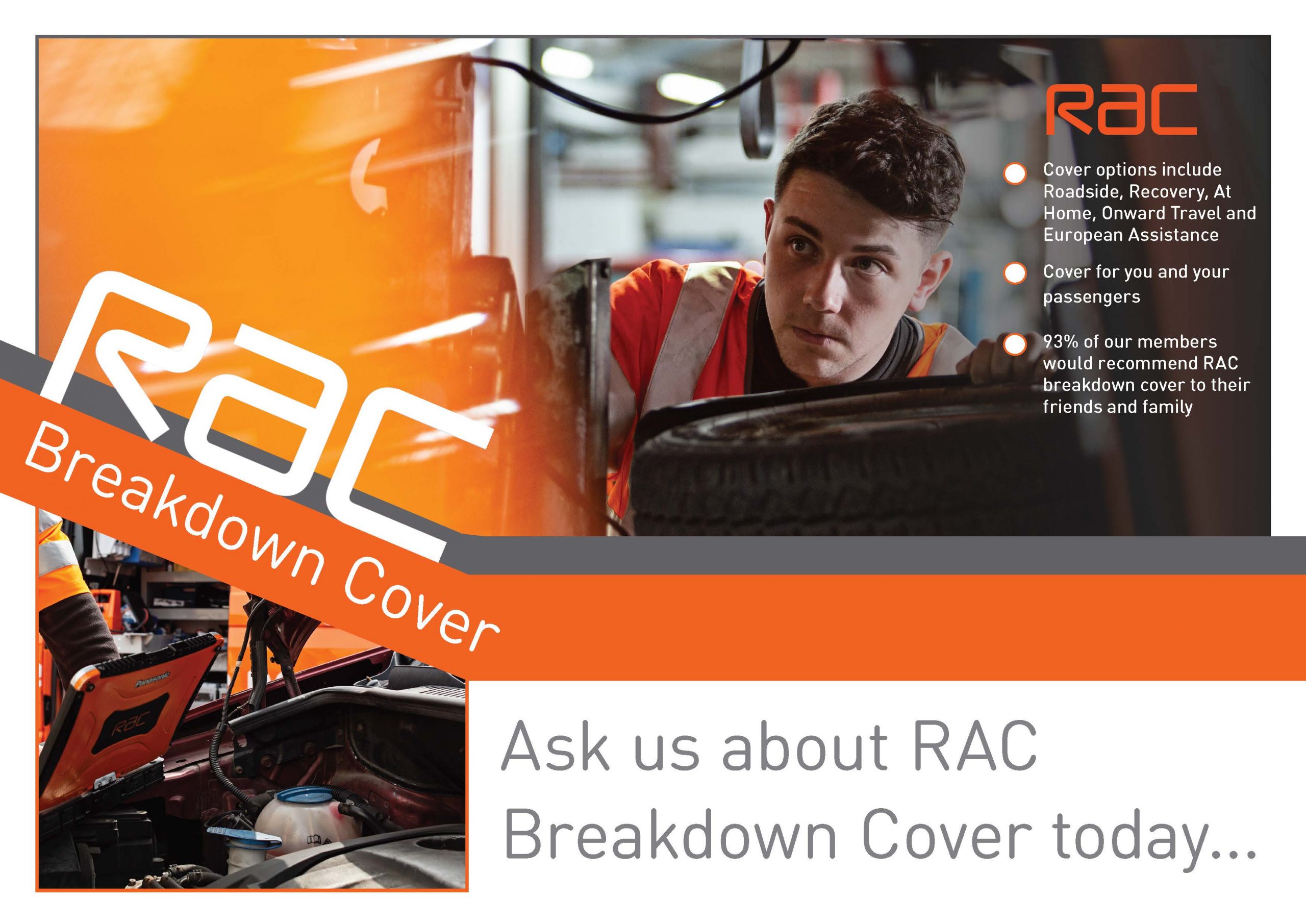

Breakdown Cover

Keeping your vehicles mobile is essential to any business.

Just like we can arrange a policy to cover all your vehicles for motor insurance. We can also arrange one policy to cover all your vehicles against breakdown.

Working in partnership with the RAC we can provide you with competitive quotes and cover to provide you with peace of mind.

You can add breakdown onto your existing cover or ask to have it included with any quoation and we can cover cars, vans or HGV’s.

Latest News

What Insurance Do I Need for a Pub?

Running a pub is more than just pulling pints and creating a welcoming atmosphere—it’s about managing risks, protecting your business, and ensuring your staff and customers are safe. From property[…]

Read moreUnderstanding Motor Fleet Insurance: Protecting Your Business Vehicles

Motor fleet insurance is a critical form of cover for businesses that operate multiple vehicles, regardless of the size of their fleet. Whether your business uses cars, vans, trucks, or[…]

Read moreThe Importance of a Confirmed Claims Experience in Motor Fleet Insurance and Why You Need It for a Quotation.

When managing a fleet of vehicles, ensuring you have the right motor fleet insurance is essential. One key piece of information insurance providers require is your confirmed claims experience, which[…]

Read more