MINI FLEET INSURANCE

Are you searching for affordable and reliable mini fleet insurance for your growing business?

Look no further than Aldium Insurance. We understand the importance of protecting your commercial vehicles and keeping your business running smoothly.

With our years of experience in the industry and partnerships with top insurance providers, we can offer you tailored cover options and competitive rates.

Request a quote from us today and let us take care of your mini fleet insurance needs.

Our transportation team has experience dealing with anything from 2 vehicles to 200 vehicles so no matter what size your business is we can provide you with a bespoke policy and review of your insurance needs.

Main Features of Mini Fleet Insurance

The main features of mini fleet insurance include:

• Cover for multiple vehicles under a single policy

• Flexibility to add or remove vehicles as needed

• Any Driver Cover

• One renewal date

• Potentially lower costs compared to individual vehicle insurance policies

• Optional extras such as breakdown cover and legal expenses insurance

• Peace of mind knowing your entire fleet is covered by a comprehensive policy

Whether you run a small business with just a few vehicles or have recently expanded your fleet, mini fleet insurance could be the solution you need to ensure all of your vehicles are properly protected.

With the ability to add or remove vehicles as needed and potential cost savings compared to individual policies, it’s worth considering if you’re looking to streamline your insurance and protect your entire fleet. And with optional extras like breakdown cover and legal expenses insurance, you can customise your policy to meet your unique needs.

Mini Fleet | FAQ

- What is mini fleet insurance?Mini fleet insurance is a type of insurance policy that provides coverage for a small number of vehicles under a single policy. Typically, mini fleet insurance covers between 2 and 5 vehicles, making it a cost-effective option for businesses with a small fleet of vehicles. You can get cover for more vehicles though.

- Who needs mini fleet insurance?Businesses with a small number of vehicles that are used for commercial purposes, such as delivering goods or providing services, can benefit from mini fleet insurance. It can also be a good option for businesses that are growing and intend to increase the number of vehicles over time and want to insure them all under one policy.

- How does mini fleet insurance differ from individual vehicle insurance?Mini fleet insurance covers multiple vehicles under a single policy, whereas individual vehicle insurance covers one vehicle at a time. Mini fleet insurance can be a more cost-effective option for businesses with a small fleet of vehicles, as it can offer discounts and other benefits such as flexible driving options such as Any Driver over 25.

- What types of cover options are available under mini fleet insurance?Mini fleet insurance policies typically offer the same types of cover as individual vehicle insurance, such as third-party, fire and theft, and comprehensive coverage. However, policies may also include additional cover options, such as breakdown cover and legal expenses cover.

- How can I get a quote for mini fleet insurance?To get a quote for mini fleet insurance, you can contact us by clicking HERE or call 0151 336 5881. You will need to provide information about the vehicles you want to insure, including their make and model, usage, and any previous claims history. Our team of experts will then search the market for you to find the best policy that suits your needs and is affordable.

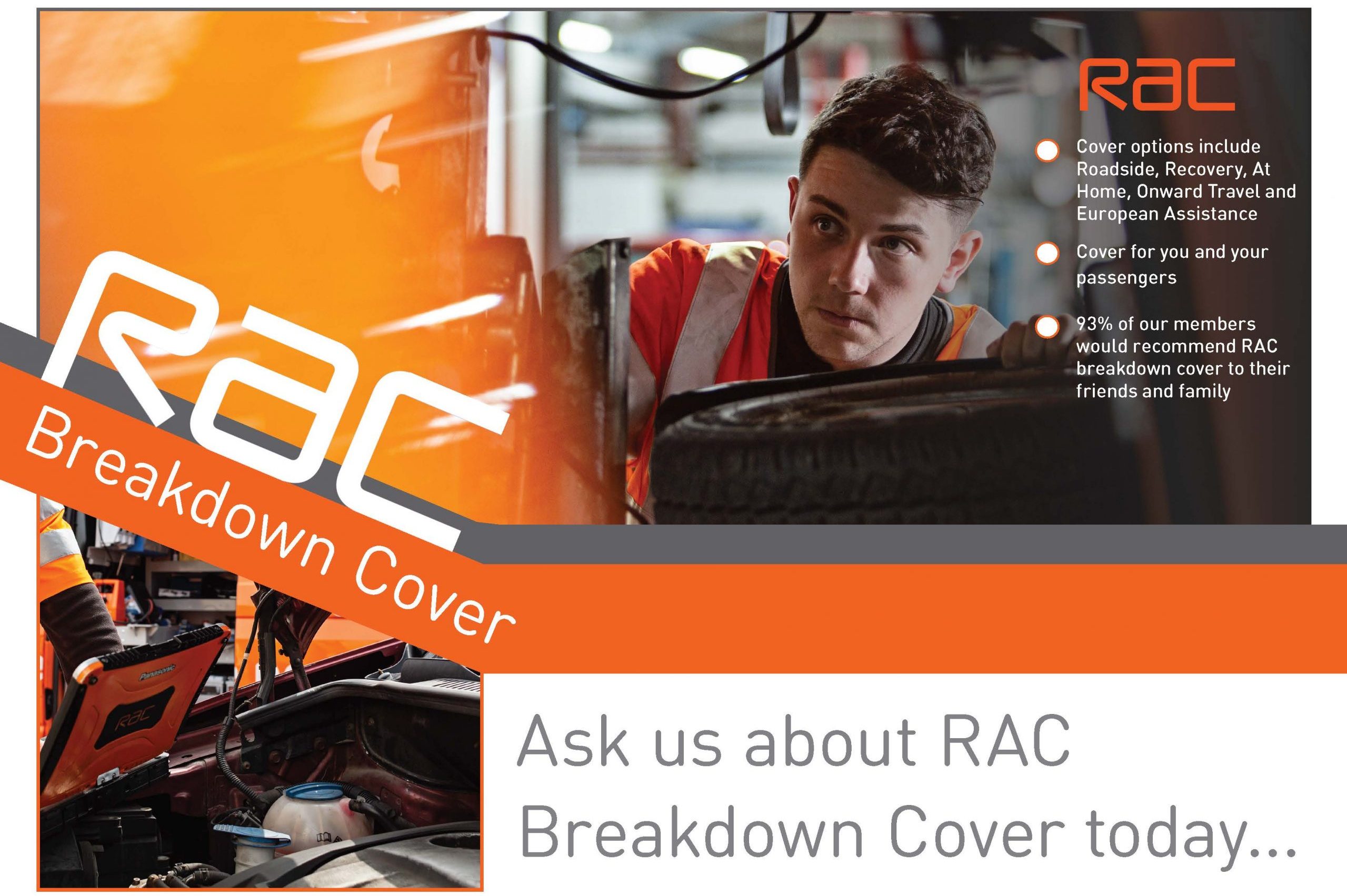

BREAKDOWN COVER

We can provide you with breakdown cover for your vehicles to keep you moving on the road.

Whether you use your car everyday, a van on the weekend, like holidaying with a motorhome or simply use your vehicle for commuting, we’ve got you covered.

We offer cover for cars, vans, bikes, minibuses and motorhomes as well as a range of specialist vehicle types with the RAC.

Ask one of our staff about including breakdown in your quotation.

QUOTE NOW

Latest News

What Insurance Do I Need for a Pub?

Running a pub is more than just pulling pints and creating a welcoming atmosphere—it’s about managing risks, protecting your business, and ensuring your staff and customers are safe. From property[…]

Read moreUnderstanding Motor Fleet Insurance: Protecting Your Business Vehicles

Motor fleet insurance is a critical form of cover for businesses that operate multiple vehicles, regardless of the size of their fleet. Whether your business uses cars, vans, trucks, or[…]

Read moreThe Importance of a Confirmed Claims Experience in Motor Fleet Insurance and Why You Need It for a Quotation.

When managing a fleet of vehicles, ensuring you have the right motor fleet insurance is essential. One key piece of information insurance providers require is your confirmed claims experience, which[…]

Read more