The Electrical Contractor’s Insurance Solution

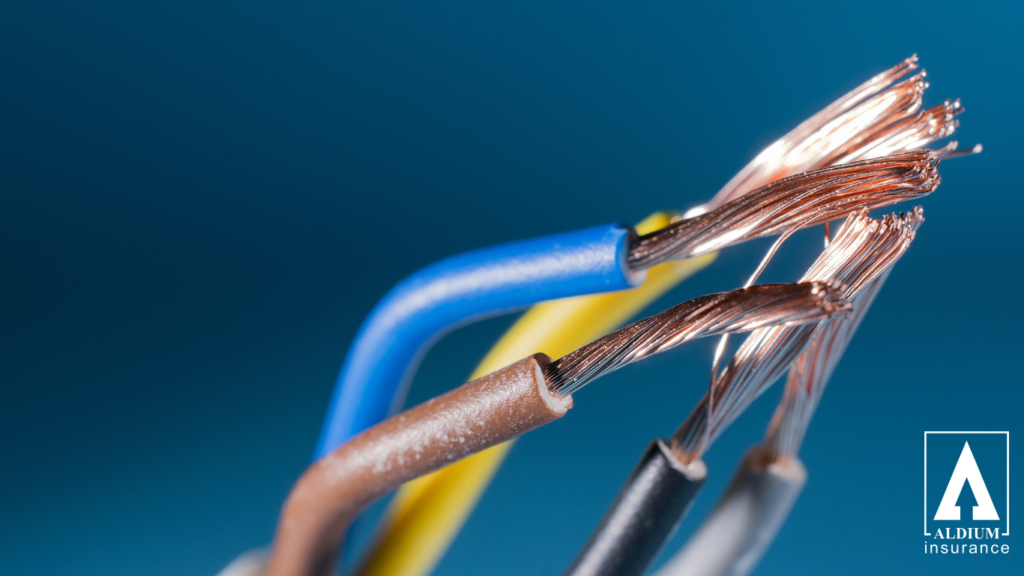

As an electrical contractor in the United Kingdom, it is essential to have adequate insurance coverage for your business. Without proper insurance, you could be at risk of costly legal fees or damages if something were to go wrong during a job. Having the right policy can help protect your business from unexpected costs and…

Read more